What are endowments and sinking funds?

In South Africa, an endowment is a long-term linked insurance policy, with at least one life assured (see Table 1), that is issued by an insurer and regulated in terms of the Long-term Insurance Act and the Insurance Act. As such, endowments are subject to certain rules and restrictions. A sinking fund has the same features and is subject to the same restrictions as an endowment but does not have a life assured.

Investing in an endowment or sinking fund may be beneficial for some investors for a few reasons:

- Tax efficiency: For individual investors, the income from the investment will be taxed at a rate of 30% (with a capital gains tax inclusion rate of 40%, the effective rate of capital gains tax will be 12%). This is advantageous for individuals who have a marginal income tax rate of more than 30%.

In the case of a trust, the tax rate applied will depend on whether the beneficiaries of the trust are individuals or corporate entities and will likely be lower than the effective rate of tax levied on a trust that is not a special trust.

- Tax administration: The tax on the investment is accounted for and paid by the insurer and recovered from the assets underlying the policy.

- Estate planning: If the investor nominates beneficiaries on the policy, the insurer will transfer the policy or pay the benefit directly to the beneficiary, and it will not need to be administered by the executor of the deceased estate. This allows heirs to access their inherited assets much faster and avoids executor fees being levied in respect of these assets.

Who are the role players?

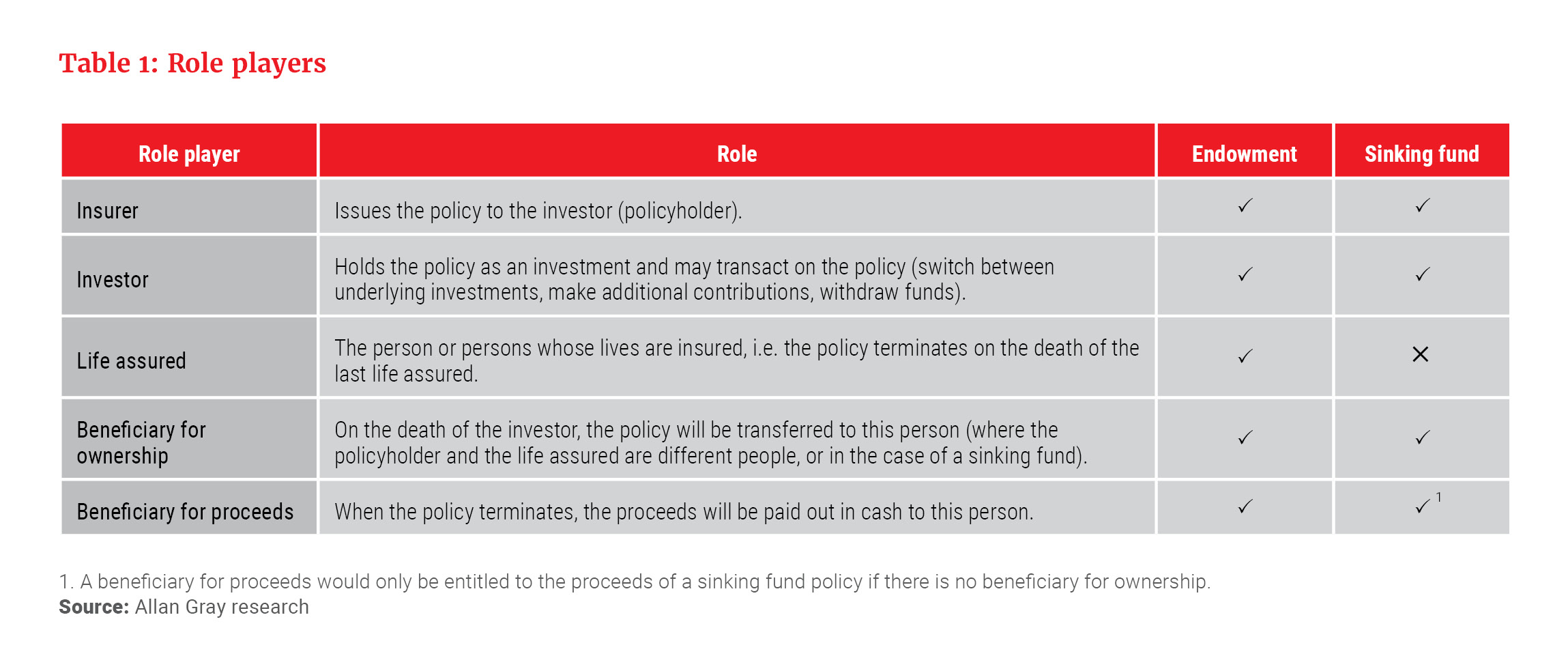

There are a number of role players when it comes to endowments and sinking funds, as described in the table below.

The thinking around the nomination of beneficiaries can get a little complicated. To keep it simple, remember that an endowment is an insurance policy with at least one life assured. As a result, the policy will terminate when the last life assured dies. For this reason, it is important to appoint a beneficiary for proceeds who will receive the proceeds of the policy when it terminates. A beneficiary for ownership is only necessary where the policyholder and a life assured are different people. In these circumstances, if the policyholder dies but the life assured is still alive, the policy will not terminate and the beneficiary for ownership will become the new owner of the policy.

On the other hand, with a sinking fund policy, there is no life assured, and the policy will only terminate when the investor withdraws the entire investment or when the investor dies and there is no beneficiary for ownership. As a result, the investor only needs to nominate a beneficiary for ownership who will become the new owner of the policy when the investor dies. It is also wise to appoint a beneficiary for proceeds who would receive the proceeds of the policy in the event that the beneficiary for ownership predeceases the policyholder or is unable to accept the benefit for another reason.

Which to choose?

Endowments and sinking funds offer many of the same benefits. As mentioned, the key difference is that an endowment has a life assured, while a sinking fund does not. This small difference has some important consequences.

Firstly, having a life assured means that the policy will automatically terminate on the death of the last life assured. If the investor and the life assured are different people, this may lead to the policy terminating sooner than intended. By contrast, the lack of a life assured means that a sinking fund will continue to exist until 100% of the investment is withdrawn or the investor dies and there is no beneficiary for ownership. For this reason, it is important for endowment investors to consider the identity of the life assured and whether it is necessary to appoint one or more additional lives assured to ensure the longevity of the policy. For legal entities, such as companies and trusts, which cannot die, it may make more sense to invest in sinking fund policies, which will continue to exist until the policyholder decides otherwise.

Secondly, in certain circumstances, the value of an endowment policy may be included in the estate of the last life assured for the purposes of calculating estate duty. In terms of legislation, the proceeds (or a portion thereof) of an endowment, which is classified as a “domestic policy”, are considered property in the estate of the deceased life assured, unless:

- The proceeds are payable to the surviving spouse or child of the deceased in terms of a registered antenuptial contract, or

- if the policy was taken out by a business partner or co-shareholder of the deceased for the purpose of enabling that person to acquire the deceased’s interest or share in the partnership or company concerned.

If estate duty is payable on the proceeds of the policy, the executor of the deceased estate will be entitled to claim that estate duty from the person who received the proceeds.

As sinking funds do not have lives assured, they are simpler than endowments in relation to estate duty consequences and beneficiaries. Only a beneficiary for ownership needs to be appointed for a sinking fund and estate duty will only be payable on the value of the policy where the policyholder was an individual who passed away.

However, sinking funds do not enjoy the protection against creditors that is provided in terms of section 63 of the Long-term Insurance Act. This protection is only afforded to investments in an endowment policy where the policyholder or their spouse is the life assured. For this reason, an endowment may be better for an individual policyholder’s estate planning.

Furthermore, where a policyholder nominates foreign beneficiaries, it is important to understand how a benefit from an endowment or sinking fund will be viewed and taxed in that beneficiary’s country of residence.

Summary of key considerations

Despite their complexity when compared to other discretionary investment products, endowments and sinking funds offer tax and estate planning benefits.

The intended longevity of investment, automatic liquidity on death, creditor protection

and tax are all important factors to consider when choosing between an endowment and a sinking fund. Individual investors who want to take advantage of the legislated protection against creditors should consider investing in an endowment, while a sinking fund policy may be a better option for legal entities and individual investors who want to ensure that their policy can continue for as long as it is needed.